PropTech - Ecommerce

Growth of +300% and expansion to 3 countries

RebajaTusCuentas was born out of the need to optimize payment times and installments on long-term mortgages. Taking into account that any debt can be renegotiated, we save up to 3 years of payments to our users. We also automated the pre-qualification of credit, reducing 3 months of processing to less than 1 minute.

- Challenge

Redesigning the mortgage market in Latam

People are always looking for the best mortgage option to buy their first property, remodel it or buy another one. However, these procedures can take up to 3 months in a country where the banking penetration rate is very low. How can we help to solve this problem?

Result

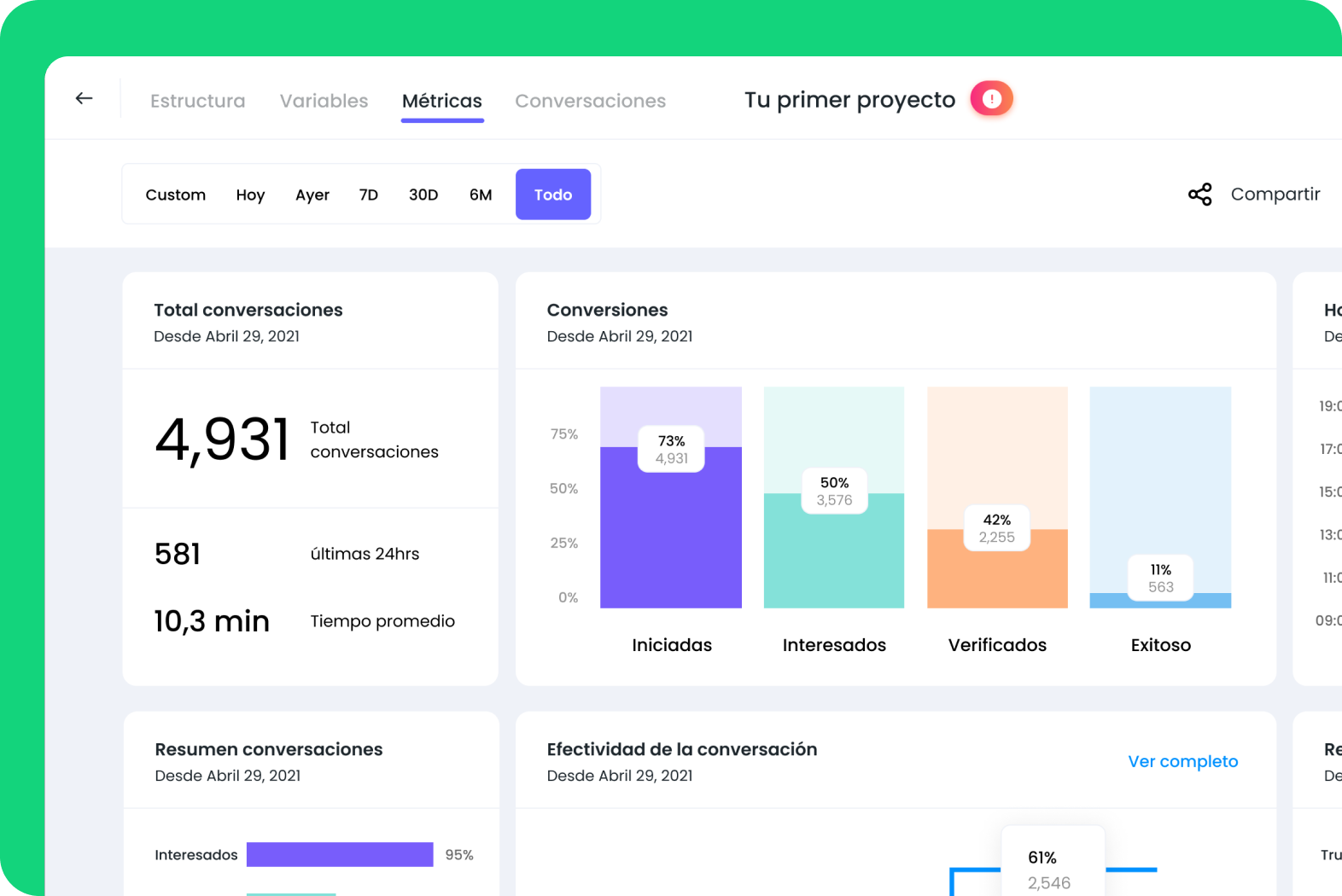

- +300% growth in 12 months.

- +60% new registrations and credit ratings.

Team by Comandos

- 3 developers

- 1 product designer

- 1 User Research

- Adventure

Organizing our first user journey

Getting ready: Where are we? and What will we need?

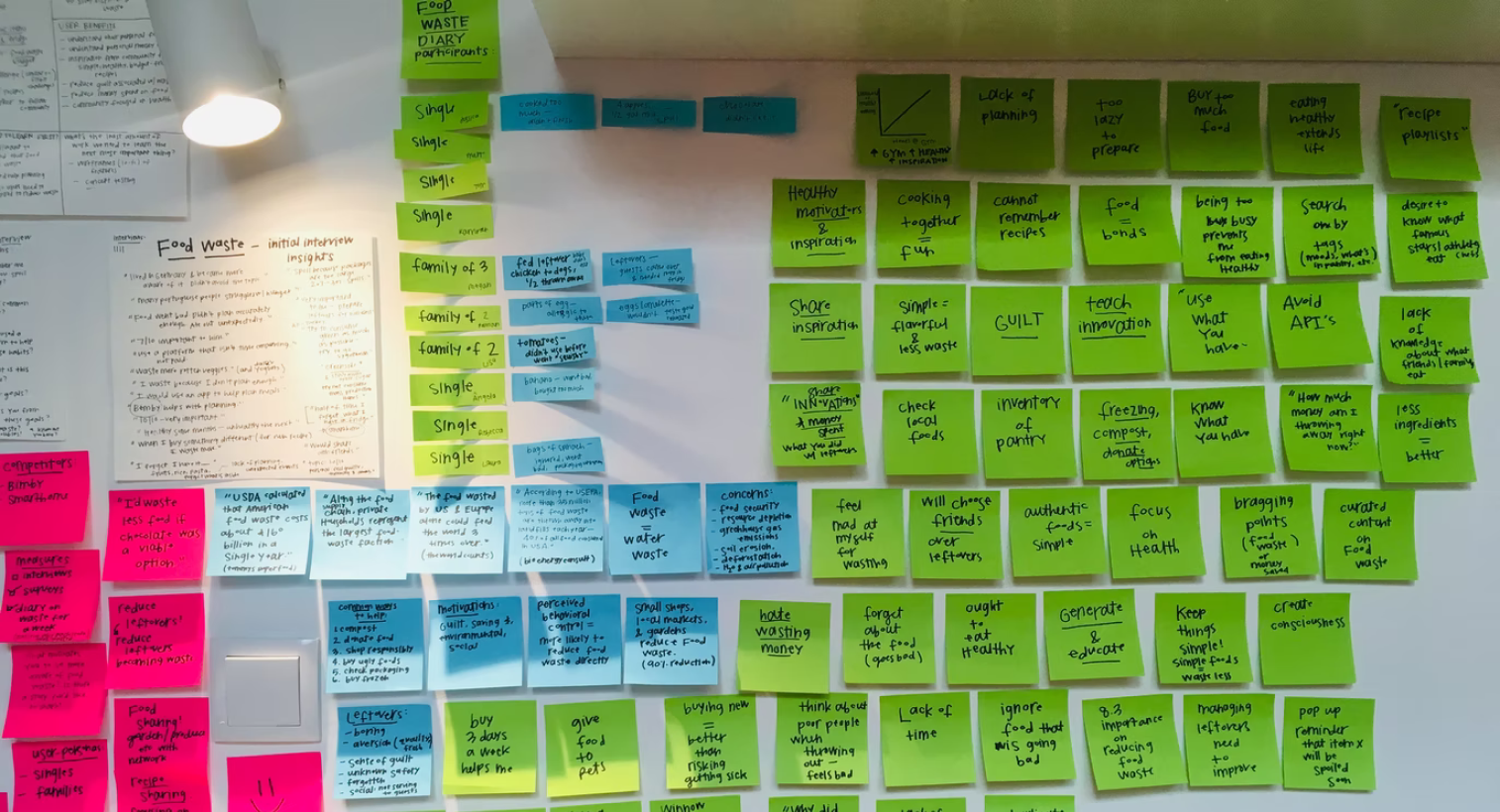

We analyzed every aspect of a mortgage and its difficulties in acquiring it in an underbanked country like Peru. We started to conduct interviews with users in different cities in Peru and it was quite challenging, due to the low internet penetration at that time we had to do it the old fashioned way: traditional phone calls and many manual notes to start feeding our data algorithms.

Our focus was on optimizing our solution to mobile devices with a very fast response rate in order not to lose the attention of our users.

- Seeing the mountain

¿Por dónde comenzar a dar valor a nuestros usuarios?

We landed everything on hundreds of post-it notes on a wall and defined our north:

- Value and security: Deliver the value of RebajaTusCuentas quickly while conveying the certainty that nothing is a fraud.

- Retention: While we could give pre-qualifications of credits in a minute, how do we get users to complete the document submission process?

STEP 01: Defining a Product-Market-Fit niche

We discovered an interesting niche: People who already had a loan with a bank and who could renegotiate the debt with another bank to obtain payment benefits. As a result, we saved time (in years) of payments.

These people were more willing to upload the necessary documentation to complete the user-journey of pre-qualification of credit. This entire process is FREE to the end user.

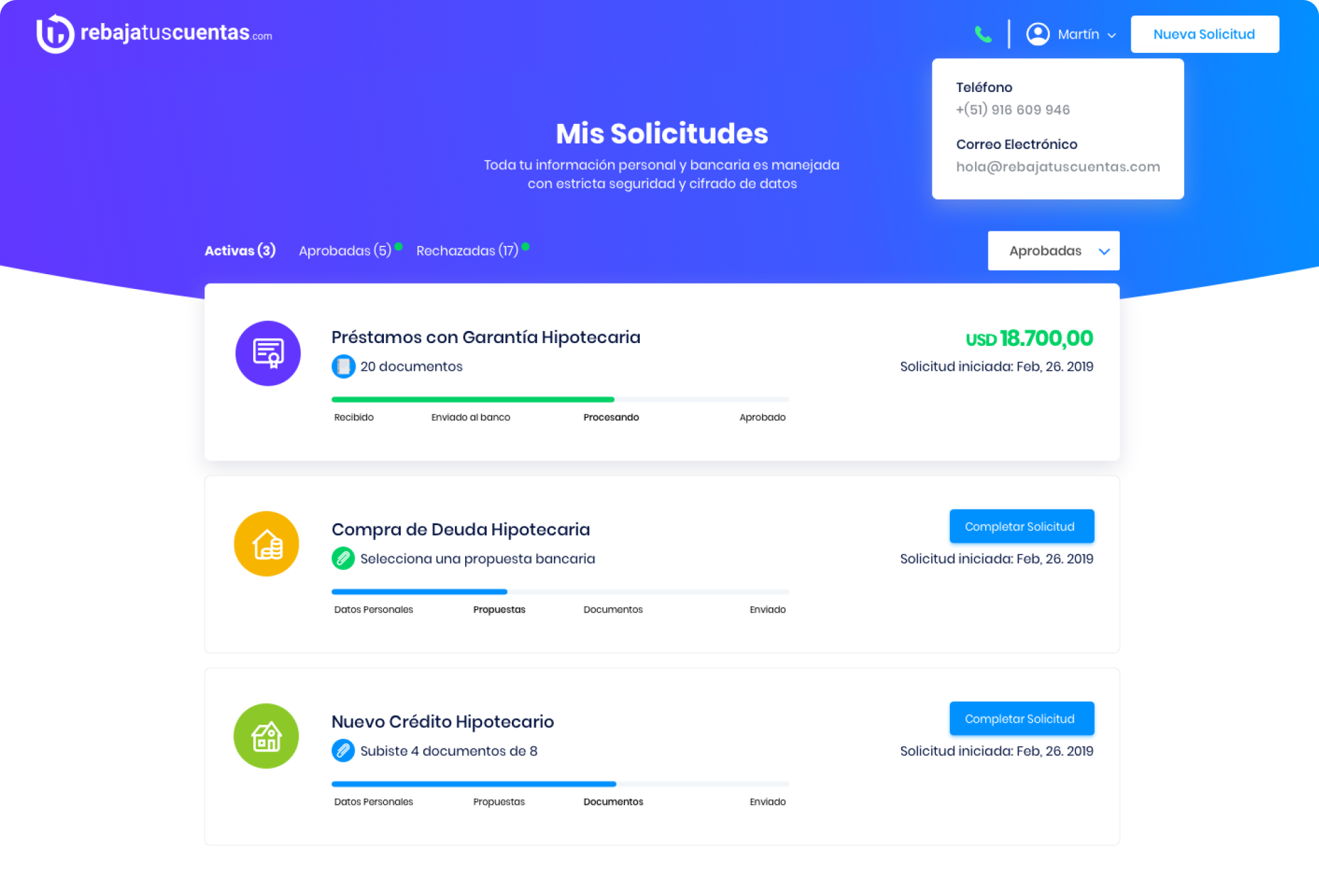

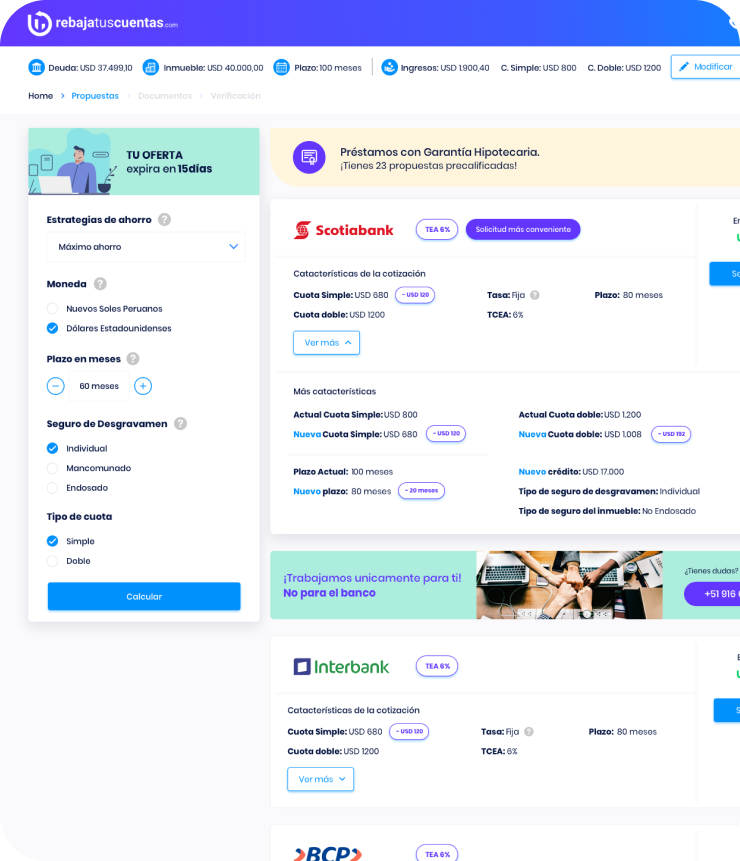

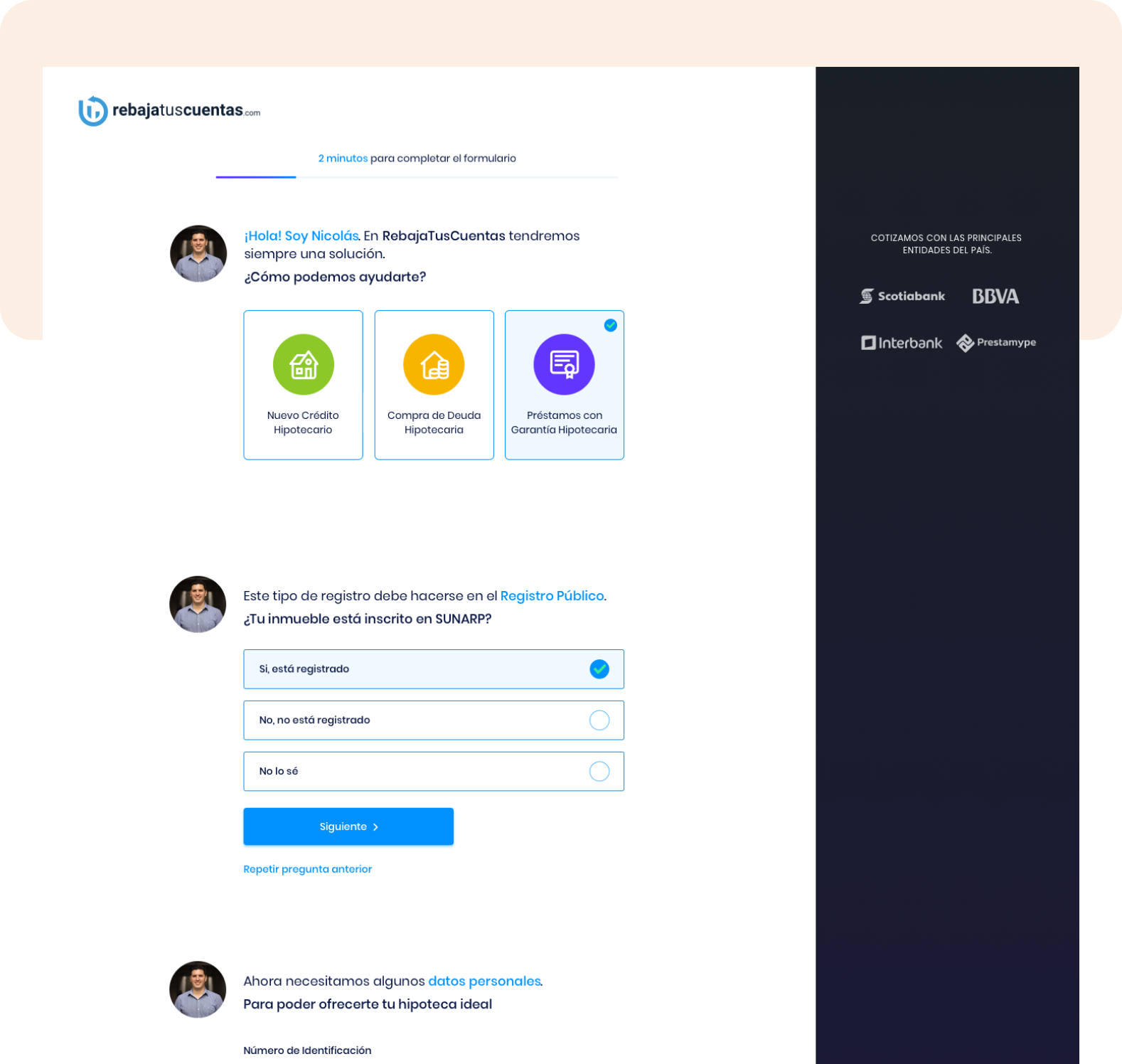

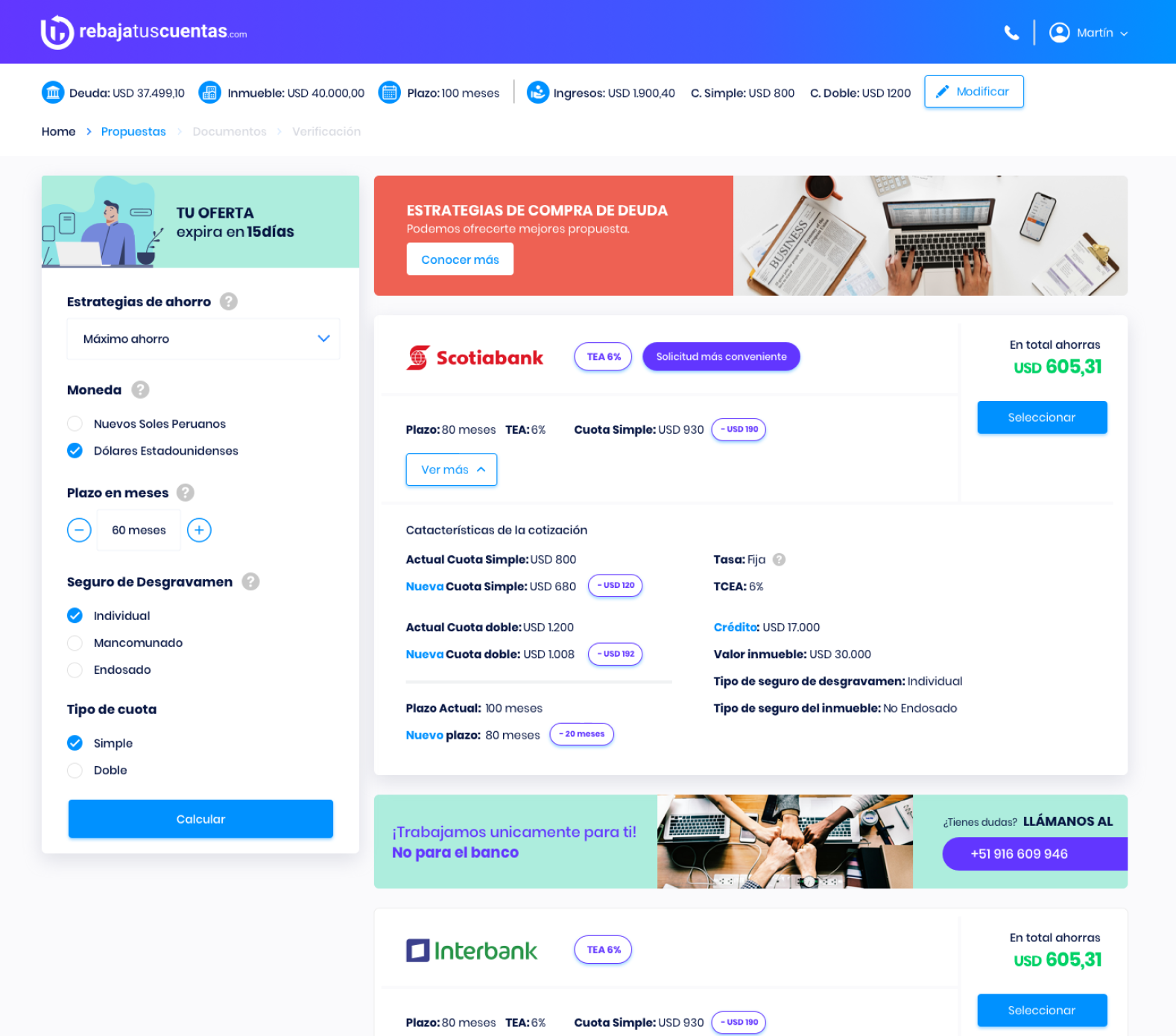

We completely redesigned the entire RebajaTusCuentas from scratch. On the left is the old user experience. On the right, an iterated version of the pre-qualified credit offer.

STEP 02: A communication for all segments

We collaborated in the redesign of the communication style of RebajaTusCuentas, paving the way to expand the business model to 3 countries: Peru, Mexico and Colombia.

A new modern graphic line that transmitted dynamism to the whole user-person target.

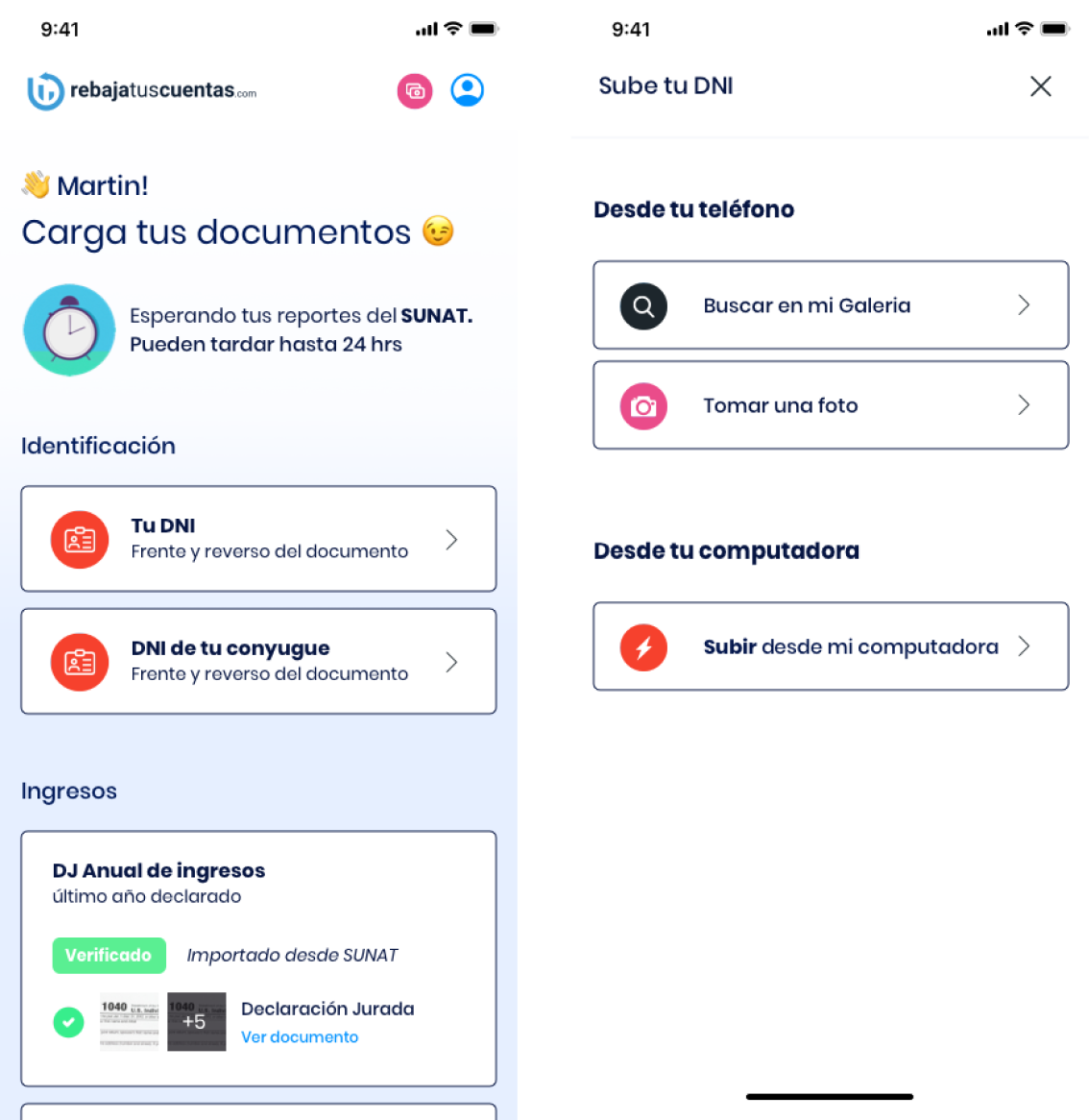

We restructure the final document upload process once a mortgage pre-approval is accepted. Internally, the process is assigned to an account executive who can provide additional follow-up on the entire process.

- Making top

A product with an amazing growth

After 6 weeks of prototyping, user interviews and some experiments we were ready to go out with an MVP and evaluate at scale. +300% growth in 12 months was the biggest result.

After 3 iterations and experimentation on the registration we achieved incredible results. From a 40-question form with a 9% conversion rate we went to an automated bot with a 60% conversion rate.

Redesign of the results of pre-authorized mortgages. Always maintaining and informing the transparency of the status of the process at all times.

- A product adapted to work on any device with low connectivity.

- Growth: +300% in 12 months.

- Retention: +82% of users completed the process. Including uploading documents.

We make possible

what seems to be impossible

Truora

TruoraTruora: A new product in less than 3 months

El aumento en el uso de WhatsApp ha llevado a que los correos electrónicos queden en segundo plano, afectando los procesos de onboarding. ¿Cómo podemos trabajar en Truora para resolver este problema?

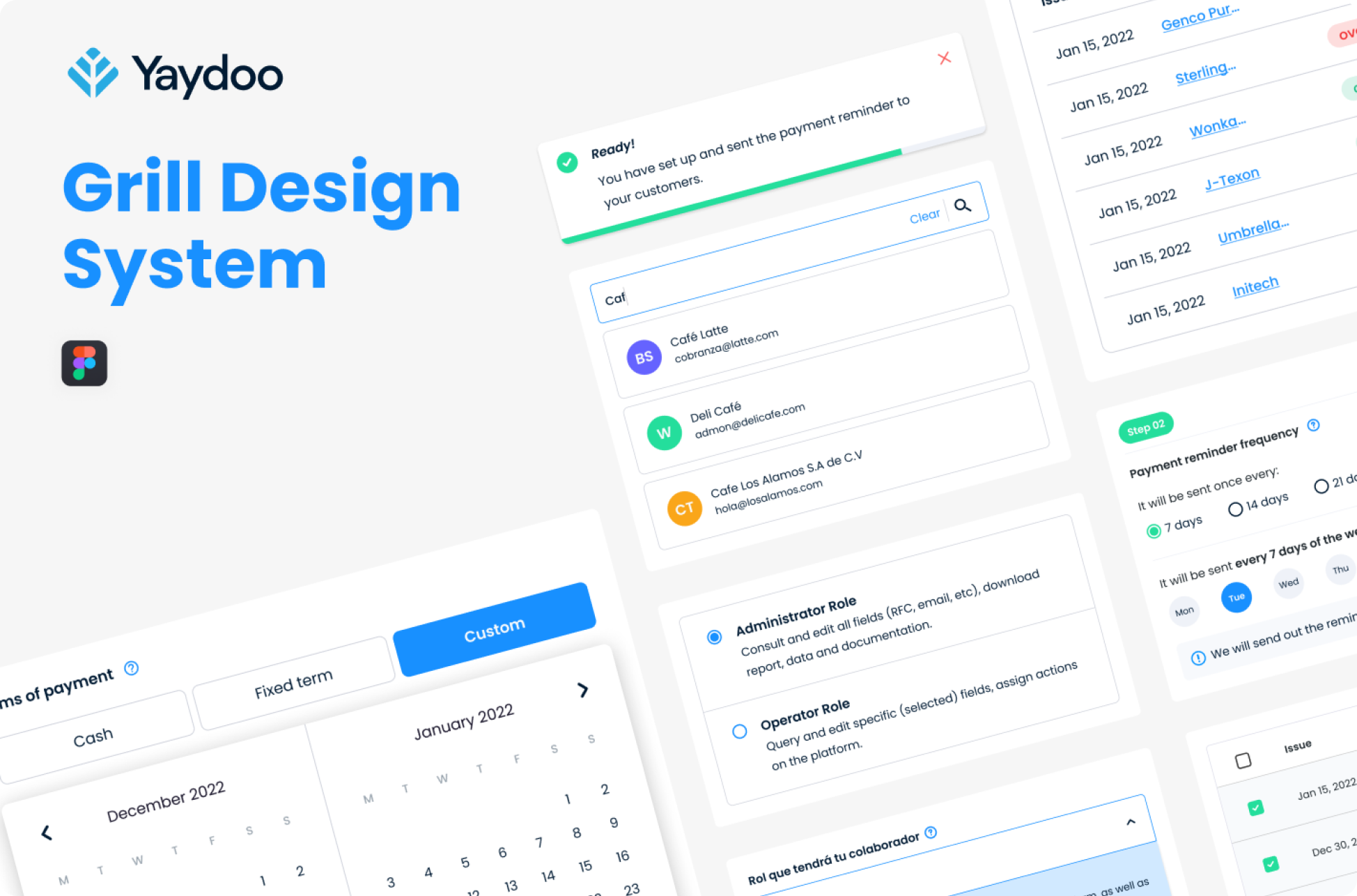

Yaydoo

YaydooYaydoo: Optimizing products, equipment and experiments

We took on the challenge of organizing +6 products with strong brand and usability inconsistencies. Increased productivity by +40%.

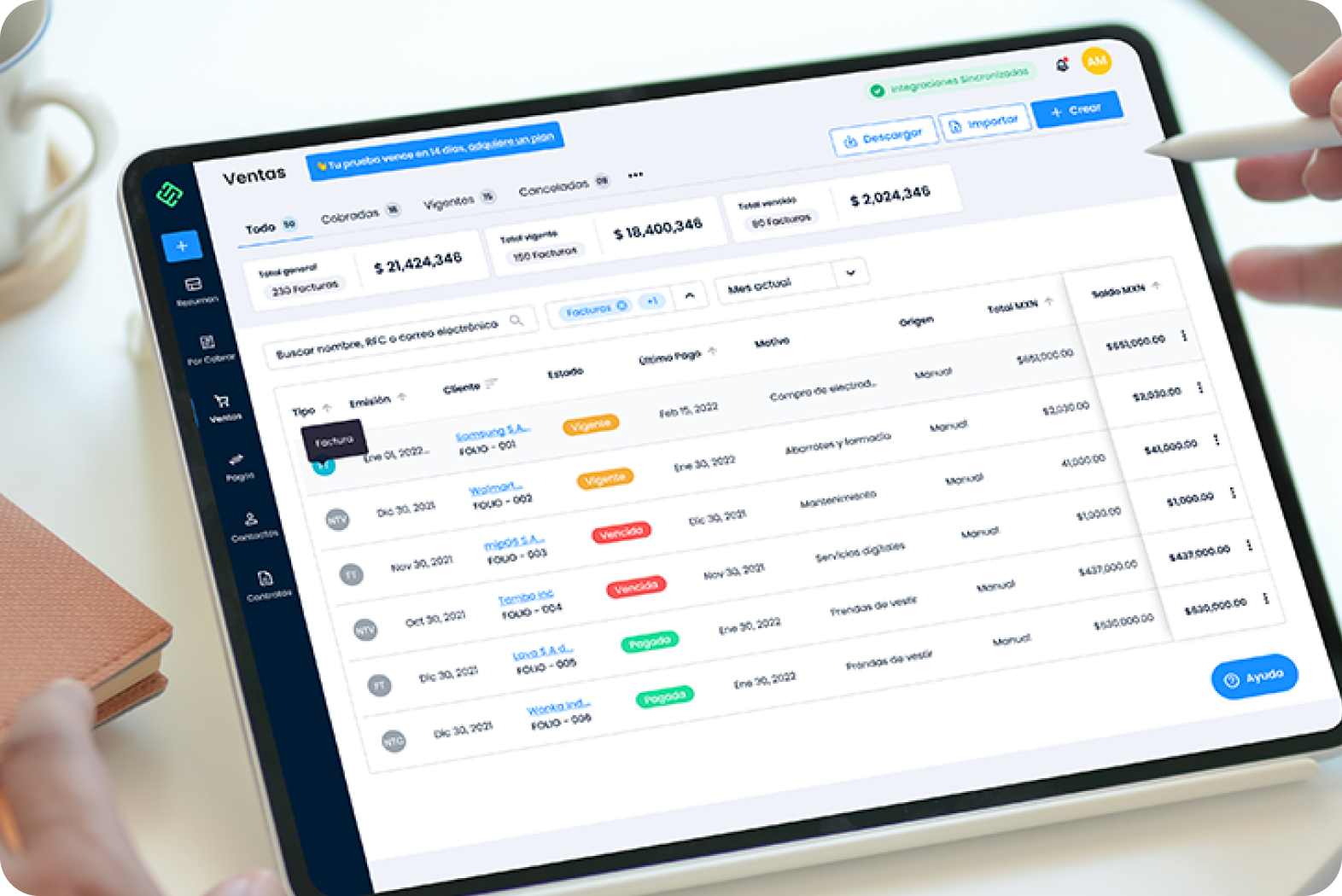

Yaydoo porCobrar

Yaydoo porCobrarYaydoo porCobrar: +40% new users in one week

We went into a product that had been on the market for 2 years to improve your experience and make more companies want to use porCobrar as their financial logbook.

Yaydoo Vendorplace

Yaydoo VendorplaceYaydoo Vendorplace: More than double the numbers of registered users

Improving the user experience in a new product that is looking for its product-market-fit can be as challenging as it is frustrating. We got to work and share the results with you.

Stadio

StadioStadio: 30% new riders in two weeks

No matter where you are, meet up with friends to run as if you were all in the same place.We achieved rapid adoption during the pandemic through Apple Watch.

RebajaTusCuentas

RebajaTusCuentasRebajaTusCuentas: +300% growth and expansion to 3 countries

A financial platform for mortgage loans that after 6 months of implementation grew exponentially with operations in 3 countries.

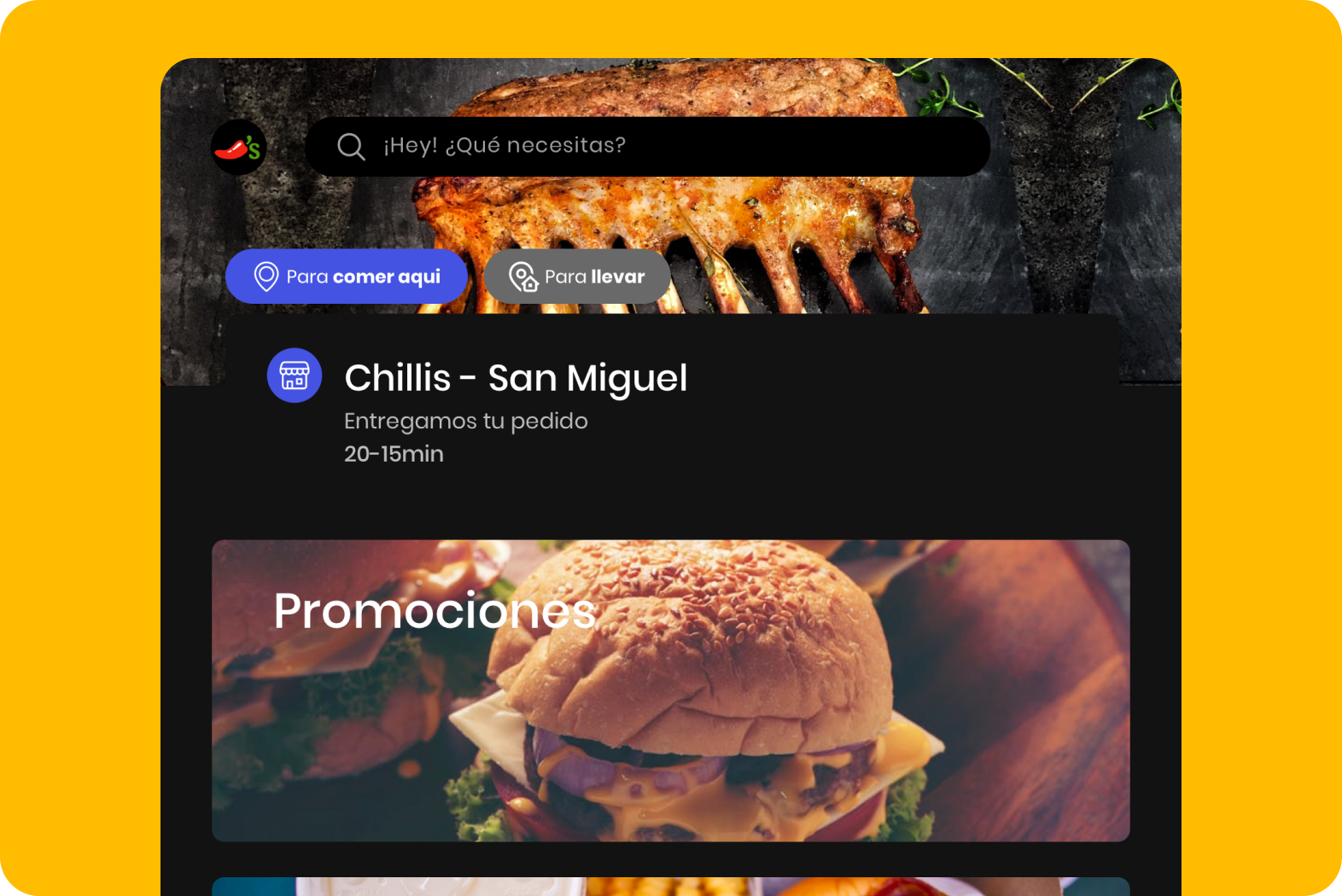

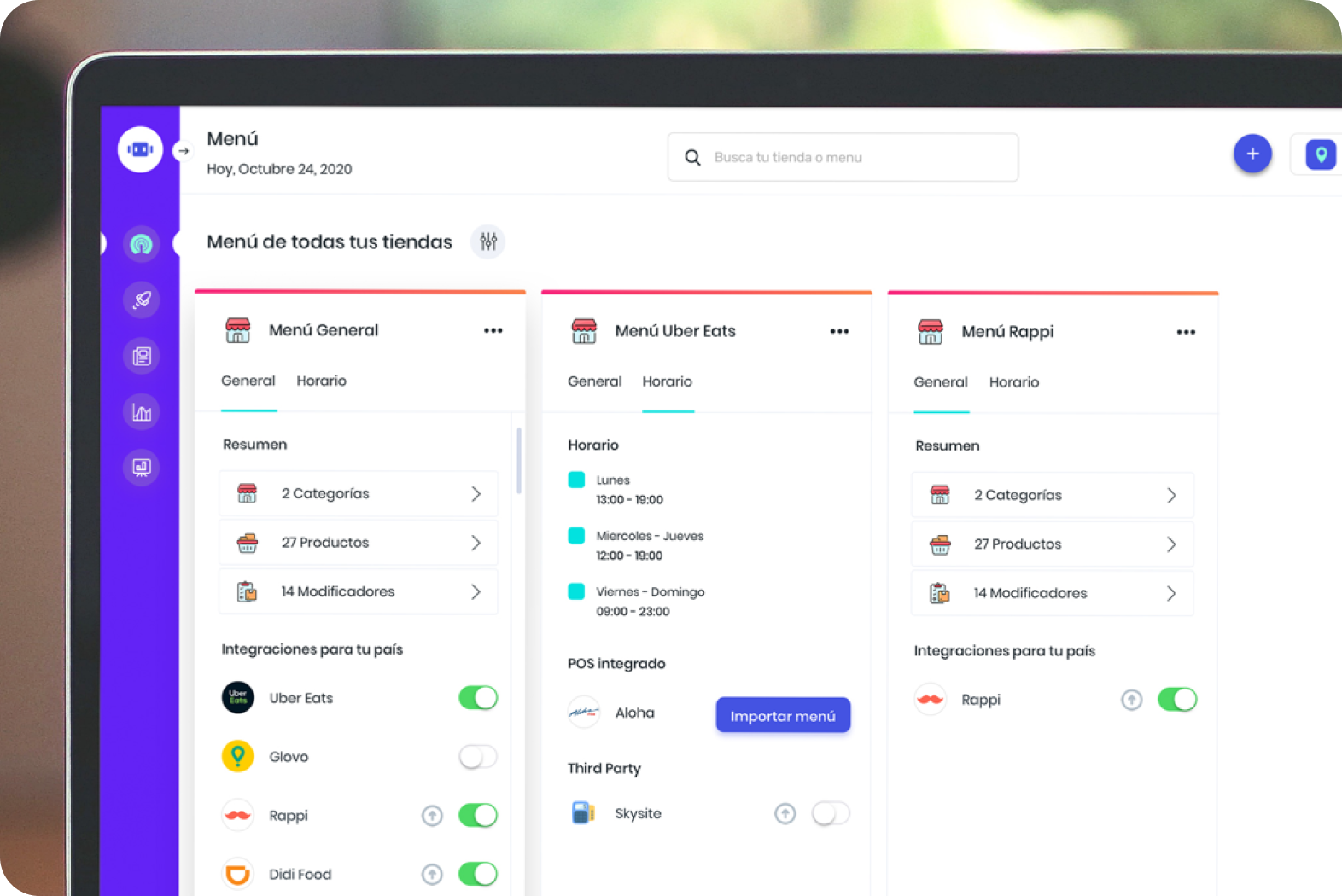

mipOS Dark Kitchen

mipOS Dark KitchenmipOS Dark Kitchen: +400% productivity increase in Dark Kitchen

We were able to concentrate the work of +40 tablets on a single screen. Imagine having 3 tablets (Uber Eats, Rappi and Didi Food) for every digital food brand a restaurant has. Now imagine having 30 hidden kitchens.

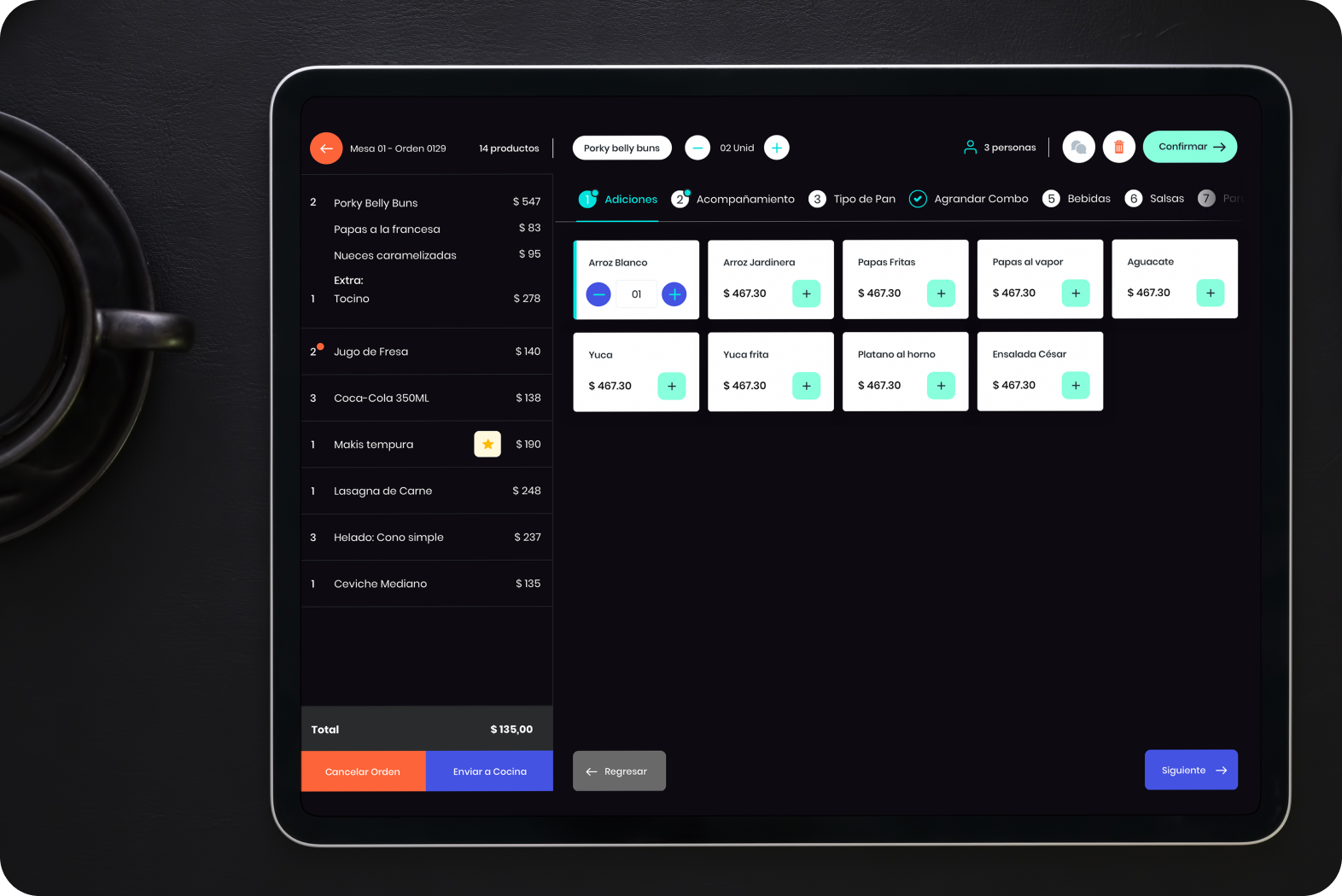

mipOS Restaurantes

mipOS RestaurantesmipOS Restaurants: 70% conversion rate of end customers

Backed by older operating systems, a great POS for the new generation of consumers.